You never know when disaster will hit close to home, making storm damage restoration necessary. Finding financial aid for natural disasters can be downright overwhelming.

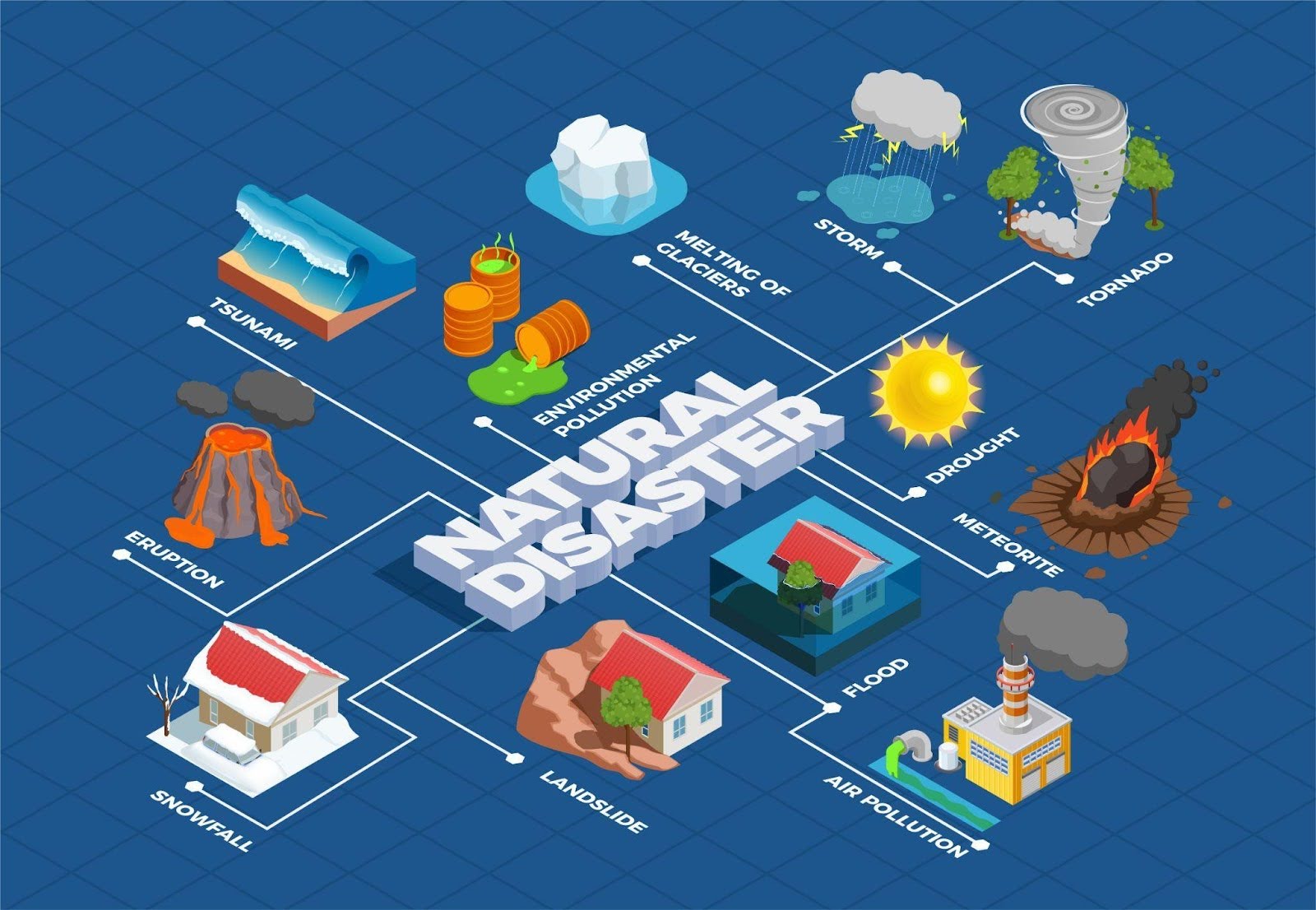

Disasters hit across the United States every day, no matter where you are. Whether you are facing fires in California, earthquakes in Utah, tornadoes in Oklahoma, or a hurricane in Florida, natural disasters are a threat. Because of this, being prepared is essential, and knowing the various financial options to protect you and your family after a natural disaster is crucial.

The reality is that more than a quarter of U.S. homeowners say they are unprepared for the potential costs of natural disasters, and many would not be able to pay their deductibles without going into debt.

Whether you dip into your savings (if you have it), tap into your accounts, or obtain financial aid from federal agencies, there are options to ensure you and your loved ones are taken care of in this time of need.

Continue reading to learn more about how to find financial aid for natural disasters below.

Table of Contents

ToggleYour homeowners’ insurance policy

Talk to your homeowners’ insurance provider as quickly as you can if a natural disaster has damaged your property. The faster you file your claim, the better.

If you live in disaster-prone areas, it’s important to be proactive. Do you have the necessary coverage based on where you live? For example, you would need flood insurance if you live along the coast or in flood zones.

Understand the ins and outs of your homeowners’ policy and what it will and will not cover. Review your policy to see what would happen in various events, like if the weight of snow were to cause roof damage, or if the pipes in your house froze. And keep in mind that there could be a time limit on how long you have to file, so file your claim quickly.

In many cases, getting a second opinion on storm damage repair services is essential. It’s also a good idea to consult an independent public adjuster, not the one provided by the insurance company. Talking with a lawyer may also be prudent.

Emergency savings

When times are good, saving money helps you stay prepared for unexpected events like severe storms or other natural disasters. In these cases, it is best to use an emergency fund rather than using your credit card, which means taking on high-interest debt.

Natural disasters can strike anytime and anywhere, so it’s wise to build an emergency savings account now to stay prepared for unexpected events.

Government options: federal agencies

The federal government typically makes resources available to help those impacted by natural disasters. The type of assistance you and your loved ones qualify for depends on your situation. Here are some common assistance programs that could provide financial aid for natural disasters:

Federal Emergency Management Agency (FEMA)

FEMA offers various programs to support victims of natural disasters. Once the area is safe, FEMA will arrive to start helping affected individuals and families survive the aftermath of natural disasters.

You could receive disaster unemployment assistance alongside on-the-ground programs providing necessities and storage, moving, and cleanup expenses. Usually, any disaster-related unemployment benefits will pay for up to 26 weeks.

Find more information and learn how to apply at FEMA’s website.

Small Business Administration (SBA)

Business owners affected by a declared disaster can find resources that the SBA provides. There are four loans available after a disaster:

- Physical damage loans

- Mitigation assistance loans

- Military reservist loans

- Economic injury disaster loans

These loans help cover business operating costs, home repairs, and other financial hardships you may encounter.

Disaster Assistance Improvement Program (DAIP)

DAIP is a lesser-known option managed by FEMA that could help you recover after a natural disaster. DAIP aims to help people find the resources they need more easily.

Head to DAIP’s website to enter your information and receive a unique list of assistance programs and resources that may be able to help you, saving you a lot of time.

Certificate of deposit (CDs), mutual funds, and savings bonds

Money tucked away in CDs, savings bonds, or mutual funds could be useful in an emergency like a natural disaster. However, withdrawing money early from these accounts could result in an early withdrawal penalty.

If you need to withdraw money from these savings accounts, talk to a financial advisor or your bank representative to better understand your options.

Your life insurance policy

If you have a cash value life insurance policy (not a term life policy), an emergency is a great time to borrow from it. You could cover necessary expenses to get back on your feet with this money; you don’t need to fill out an application to access your money. Remember that repaying the money is unnecessary, but your beneficiaries will receive less, so you’ll want to if you can.

Contact Total Flood and Fire Restoration for all your restoration needs

A natural disaster can turn your world upside down in a matter of minutes, leaving behind damage, debris, and uncertainty about where to start. That’s why the professionals at Total Flood and Fire Restoration are ready around the clock to help you recover.

Our experienced team provides fast, reliable storm damage repair and restoration services 24/7. We work quickly to secure your property, assess the damage, and start the cleanup and repair process immediately.

From powerful wind and hailstorms to heavy flooding, we understand the urgency and emotional toll of storm damage. Our certified technicians use advanced equipment and proven techniques to remove water, dry and dehumidify affected areas, and repair structural damage safely and efficiently.

We also assist with mold remediation, fire and smoke restoration, and biohazard cleanup, giving you a single, trusted source for complete property restoration.

At Total Flood and Fire Restoration, we take pride in being Utah’s #1 restoration company. We’re dedicated to restoring your property and your peace of mind. Our compassionate team communicates every step of the way and works directly with your insurance provider to make the process as smooth as possible.

If you live in Utah, Salt Lake, or Davis Counties and need expert storm damage repair, don’t wait — every moment counts after a disaster. Contact Total Flood and Fire Restoration today to get immediate help and start rebuilding your home and your confidence.