Amidst the chaos of discovering sewage damage in your home, filing an insurance claim may seem overwhelming. Sewage damage, a destructive and potentially hazardous form of water damage, requires timely and proper handling to mitigate its effects.

Before you start cleaning up, you need to understand the intricacies of insurance policies and the types of water damage they cover.

This guide is a lifeline for those submerged in the aftermath of sewage-related disasters. It will walk you through the murky waters of filing claims, negotiating settlements, and securing the right coverage for water damage.

Understanding water damage claims

When faced with sewage or other types of water damage, knowing what your insurance policy covers is the first step in the claims process. Most standard homeowners insurance policies provide coverage for water damage, but the source and type of water damage often determine eligibility for a claim.

For instance, while your policy might cover a sudden burst pipe, it might not provide coverage for maintenance issues such as mold growth due to lack of maintenance or sewer backups.

Initiating a water damage insurance claim usually involves contacting your insurance company promptly to report the damage. It’s essential to document the damage with photos or videos and make a list of damaged personal property. This includes noting the item’s description, the Actual Cash Value, or Replacement Cost if you’re entitled to it under your policy.

Keep in mind that insurance providers often differentiate between replacement cost, which covers the cost to buy new items, and actual cash value, which accounts for depreciation.

Conducting temporary repairs to prevent further damage may also be part of the claims process. However, always check with your insurance provider before proceeding, as unauthorized repairs might not be compensated.

An insurance adjuster will typically assess the damage to determine the scope of coverage. In some cases, policyholders choose to work with a public adjuster to ensure a more favorable claim settlement. Ultimately, your insurance agent provides valuable guidance and clarification on filing water damage insurance claims.

Flood damage, a different type of water damage, generally requires a separate flood insurance policy, which is not included in a standard home insurance policy. Knowing these details helps streamline your claims process and avoid unexpected denial of claims.

Types of water damage

Water damage incidents come in various forms, each with its insurance implications. The types of water damage often recognized by insurance companies include:

Sudden and accidental damage

This encompasses unforeseen events such as a burst pipe or appliance leaks. This type is typically covered by a standard homeowners insurance policy.

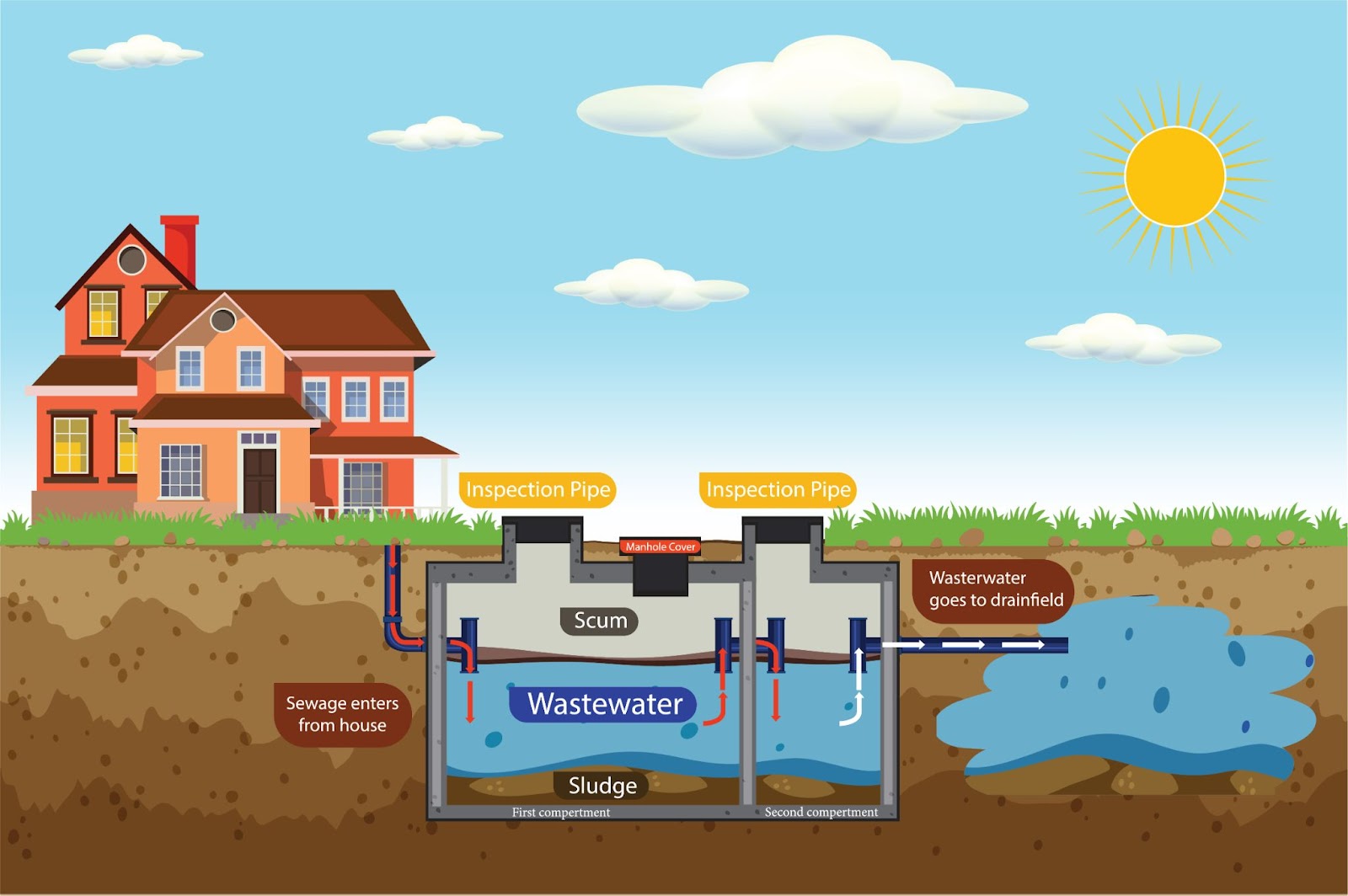

Sewer backups

Though common, not all policies include sewer backup coverage. It often requires an additional endorsement or policy.

Sump pump failure

A standard policy may not cover it without an added endorsement for sump pump failures or similar system overflows.

Mold growth

Mold growth is generally covered only if it’s a result of a covered water damage claim. Lack of maintenance claims involving mold are usually not included.

Flood damage

It is crucial to note that flooding is not covered by a standard policy and requires separate flood insurance.

Understanding these distinctions is vital when assessing your current coverage and deciding whether supplemental policies are necessary for comprehensive protection.

Common causes of sewage damage

Sewage damage can stem from various sources, impacting insurance coverage differently. Here’s what to watch for:

- Heavy rain: Excessive rainfall may overwhelm sewage systems, leading to backups and flooding in homes.

- Faulty appliances: Malfunctions in appliances like toilets or sewage pumps may result in sewage spills.

- Plumbing issues: Burst sewer lines or leaks within the plumbing system may cause sewage backups and overflows.

- Maintenance issues: Neglected sewer lines or lack of maintenance can exacerbate sewage problems, often not covered by standard policies.

- Natural disasters: Floods or storms can exacerbate sewage issues, requiring specialized coverage for adequate protection.

- Sewer backups and overflows: Common during heavy rain or due to blockages, these incidents often warrant separate or additional insurance coverage.

Understanding the source of sewage damage is vital for homeowners to ensure they have appropriate insurance coverage before facing a sewage-related disaster.

Coverage for sewer backups

Homeowners may find themselves at a loss when dealing with sewer backups, as standard homeowners insurance policies typically do not cover such incidents without specific add-ons or endorsements. Given that sewer backups often result in significant property damage and potential health risks, obtaining this extra coverage is a prudent decision for many.

Sewer backup coverage safeguards against water damage caused by sewer or drain backups and sump pump overflow. It’s a crucial shield against costly bills, especially when maintenance issues contribute to the backup.

Remember, negligence-related maintenance problems may not be covered. Consult your insurance agent to customize your policy, including coverage limits and deductible options, to best suit your needs.

The claims process

Quick action is crucial to minimize harm and to comply with any time-sensitive policy requirements. The following guide outlines the main steps in the claims process for sewage damage.

Immediate notification

As soon as you detect the damage, contact your insurance company to notify them of the incident. Be prepared to provide basic information about the extent and suspected cause of the damage.

Documentation

Take photos and videos of the affected area and any damaged property. This visual evidence is invaluable for substantiating your claim.

Emergency measures

Implement any necessary temporary repairs to prevent further damage, keeping all receipts as you may be reimbursed. However, only do this after consulting with your insurance provider.

Policy review

Revisit your insurance policy to confirm that sewage backup is covered. Knowing your policy details aids in setting realistic expectations for the claims process.

Adjuster appointment

Your insurance company will send an insurance adjuster to examine the damage and estimate repair costs. They play a vital role in the claim settlement.

Claim forms

Complete all required claim documentation as accurately as possible, providing ample detail to support your claim.

Repair quotes

Obtain quotes from contractors for repairs. While your insurance adjuster will make an estimate, having additional quotes can support your claim.

Claim follow-up

Stay in regular communication with your insurance agent to track the progress of your claim and provide any additional information required.

Settlement

Once your claim has been evaluated, your insurance provider will offer a settlement. Review the offer carefully before accepting it to ensure it covers the necessary repairs.

Every step in this sequence is crucial to the ultimate success of your claim. Insurers have strict policies about claims reporting and handling, so adherence to their procedures is a must for the best outcome.

Filing a claim for sewage damage

Filing a sewage damage claim requires detailed documentation and adherence to policy terms:

- Fill out a “Proof of Loss” form provided by your insurer, itemizing damaged property.

- Submit supporting documents, including repair receipts and contractor estimates.

- Keep records of all correspondence and claim progress for potential disputes.

- Await evaluation by the insurance adjuster and negotiate for a fair settlement.

- Challenge insufficient settlement offers if necessary, with the option of seeking professional assistance.

Thorough documentation is key to expediting and ensuring the success of your claim. Working closely with your insurer simplifies the recovery process from sewage damage.

Preventing future sewage damage

To prevent sewage damage and avoid cumbersome insurance claims, homeowners should take proactive steps to maintain their property.

Regular inspections and prompt addressing of clogs are essential. Avoid flushing non-disintegrating items and manage tree roots near sewer lines. Consider installing a backwater prevention valve and ensure sump pump maintenance.

These efforts significantly reduce the risk of sewage damage, saving homeowners from potential stress and financial strain.

Additionally, investing in flood insurance is crucial, especially for properties in flood-prone areas. While standard homeowners insurance may not cover flood damage, flood insurance offers protection against external flooding events like heavy rainfall and storm surges.

Government programs like the NFIP provide flood insurance, with premiums based on the area’s flood risk level. Review policy details, including deductibles and coverage limits, to fully understand what is covered.

Regardless of the flood risk level, flood insurance offers peace of mind and financial security against the unpredictable impact of flooding on your property.

Trust Total Flood and Fire Restoration for sewage damage clean-up

Total Flood and Fire Restoration offers comprehensive cleanup services that not only meet insurance standards but also exceed expectations. With our expertise and dedication, trust us to handle your sewage damage restoration efficiently and ensure a smooth and successful insurance claim process.

Don’t deal with sewage damage alone — contact Total Flood and Fire Restoration or call 385-503-2846 anytime for expert assistance and peace of mind.